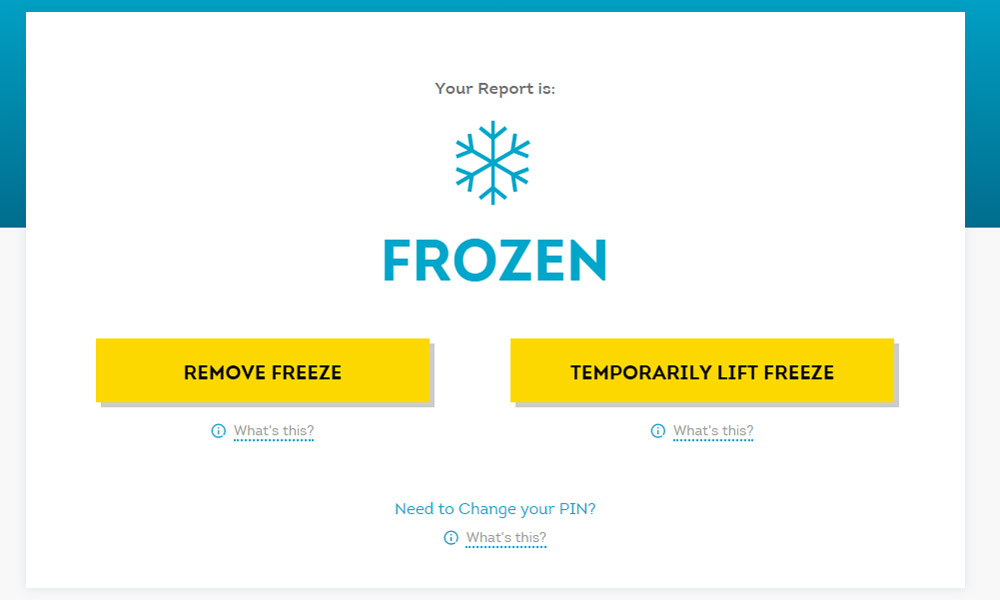

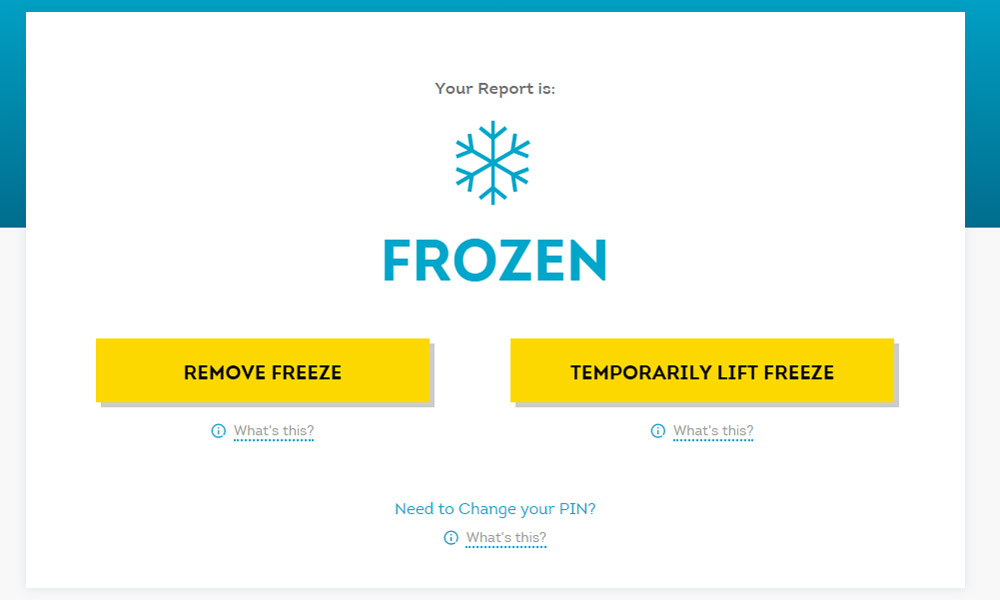

You can request your security freeze, or temporarily lift or permanently remove your security freeze, as well as order a replacement PIN for either yourself, a minor child (under the age of 16), or a protected consumer using our online Security Freeze Forms. If the consumer would like their security freeze lifted, please instruct them to call LexisNexis Risk Solutions at 1-80. The actual alert that appears on a consumer's report appears below: The subject of this consumer report currently has a security freeze on file preventing the return of the information you requested. Any inquiries NOT deemed as having a permissible purpose, will not return any consumer information. If the purpose has been deemed to be permissible, information will be returned and an inquiry will show on the consumer's report even when a security freeze is in place. Permissible Purposes are mandated by each state, therefore a consumer's state of residence determines what information is permissible to return. LexisNexis Risk Solutions offers security freezes–and lifts security freezes–free of charge.

A consumer will receive their LexisNexis Consumer Disclosure Report, if they request it. No consumer information is returned to a customer if the consumer has a security freeze on their file, and the customer's permissible purpose is one that the consumer's state of residence had determined blocks the report. When this occurs, a customer that inquires on the consumer receives only a notification that the consumer has placed a security freeze on their file.Ī security freeze has the following effects on a consumer's report: Security FreezeĪ consumer has the right, pursuant to state law, to request a security freeze be placed on certain LexisNexis Risk Solutions reports, and for LexisNexis Risk Solutions to not release those reports without the consumer lifting the security freeze. For example, the security freeze will not be in place at TransUnion, Equifax or Experian, Innovis or others. LexisNexis Risk Solutions does not charge a fee to apply, lift or remove a security freeze from your file.Īll security freezes that are requested through this portal will only be in place at LexisNexis Risk Solutions and SageStream and not other credit reporting agencies. Reviewing the account includes activities related to account maintenance, monitoring, credit line increases, and account upgrades and enhancements. However, a security freeze does not apply to companies, or collection agencies acting on behalf of such companies, with which you have an existing account that requests information in your consumer report for the purposes of reviewing or collecting the account. The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. You’re still vulnerable to existing account fraud, where a crook steals your credit or debit card number and starts buying things.Consumer Portal Request a Security Freeze Freeze Access to Your Credit FileĪpplying a security freeze prohibits LexisNexis Risk Solutions and SageStream from releasing your LexisNexis Consumer Disclosure Report, your SageStream Consumer Report, or your credit score without your express authorization. It doesn’t keep the horse from getting out of the barn all it does is tell you the horse is gone.” A freeze isn't a silver bulletĪ security freeze is an important fraud-fighting tool, but it doesn’t stop all forms of identity theft, just the creation of new financial accounts in your name. “If you get credit monitoring for free, it doesn't hurt to combine it with a freeze, but credit monitoring doesn’t prevent identity theft – it simply alerts you to a problem. “A security freeze is the most effective measure you can take to prevent identity theft,” said Chi Chi Wu, staff attorney for the National Consumer Law Center. They can’t do that with a freeze, Litt said.ĭon’t confuse a freeze - or even a lock - with credit monitoring which looks for potential signs of fraudulent activity. #Transunion freeze lift phone number free#

If you sign up for the free credit lock at Equifax or TransUnion, your information can be used for marketing purposes. “Your rights as a consumer are on firmer ground with credit freezes.”

“Credit freezes are a right mandated by law and not conditional on terms set by companies the way credit locks are,” said Mike Litt with U.S.

0 kommentar(er)

0 kommentar(er)